The global steel industry is undergoing significant changes, driven by economic, environmental, and regulatory factors. These shifts are creating numerous opportunities for the acquisition of used steel production equipment.

Trends in Steel Production Relocation

Several key trends are shaping the global steel production landscape:

- Overcapacity and Regional Shifts: Steel-producing regions like China are now investing in overseas production, especially in the ASEAN region, to manage domestic overcapacity and capitalize on lower production costs.

- SteelAsia Manufacturing recently announced a planned investment of $1.11 billion to establish four new production facilities across Philippines. Similarly, other Chinese firms have invested in Malaysia and Indonesia, leveraging lower production costs and avoiding tariffs imposed on Chinese steel exports.

- The ASEAN region has already seen a substantial increase in steel production capacity in recent years and, according to the OECD, the region is expected to take the lead in global steel capacity expansion, with the potential for double-digit growth underway in the next three years.

- Cost and Efficiency: Emerging markets such as India, Vietnam, and Indonesia are becoming attractive locations for steel production due to lower labor costs and favorable economic conditions. These regions are receiving increased investment from international steel companies seeking to enhance efficiency and reduce production costs.

- India has attracted significant investment in its steel sector. For instance, ArcelorMittal, one of the world’s largest steel producer, announced a $6 billion investment in a joint venture with Nippon Steel to enhance production capacity in India. Similarly, Vietnam has seen increased investments from South Korean and Japanese steel companies, such as POSCO and JFE Steel, due to favorable economic conditions and a growing domestic market.

- Environmental Regulations: Stricter environmental regulations and high energy prices in Europe are pushing steel manufacturers to heavily invest in more sustainable production technologies. Some may decide for plant closure or relocation.

- The European Union has implemented stringent environmental regulations, such as the Emissions Trading System (ETS), which increases the cost of carbon emissions. This has significantly impacted the steel industry, which is one of the largest carbon emitters. According to the European Steel Association (EUROFER), compliance with these regulations has added substantial costs to steel production in Europe.

- Some European steel plants have faced closures due to the high costs of complying with environmental regulations and high energy prices. For example, British Steel faced bankruptcy in 2019, partly due to the high costs of carbon credits and energy.

- Other European steel plants are undergoing significant changes to comply with new environmental regulations and manage high energy costs. For instance, Tata Steel’s IJmuiden plant in the Netherlands announced plans to shift to hydrogen-based direct reduced iron technology and electric arc furnaces. Similarly, other steel producers across Europe are investing in greener technologies and processes to meet stringent environmental standards, with some considering relocating production to regions with more favorable economic and regulatory environments due to the high costs associated with these compliance measures.

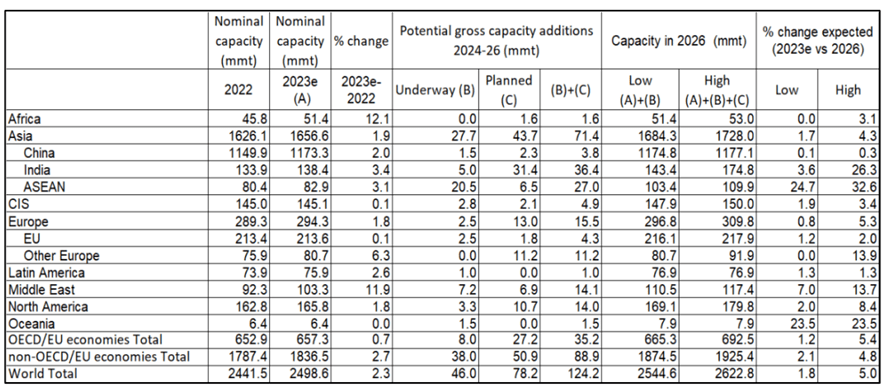

Nominal capacity and potential gross capacity additions by region –

OECD(2024), Latest Developments In Steelmaking Capacity

Potential gross capacity additions by region and equipment type from 2024 to 2026 (mmt)

OECD(2024), Latest Developments In Steelmaking Capacity

Opportunities in Used Equipment

The closure of production sites, shift of technology and relocation of steel production is opening up significant opportunities for acquiring used equipment:

- Cost Savings: Purchasing used equipment can be more cost-effective than investing in new machinery, offering substantial savings for companies looking to expand or upgrade their production capabilities.

- Availability: The shutdown or relocation of steel plants is more often making a wide range of high-quality, well-maintained equipment available on the market. This includes everything from melting and rolling machines to specialized processing equipment.

- Reduced Lead Times: used equipment typically has shorter lead times compared to new machinery, enabling quicker deployment and scaling of production facilities.

How Hilco Industrial Can Assist you?

Hilco Industrial is uniquely positioned to help companies navigate the complexities of acquiring used steel production equipment. Here’s how:

- Valuation and Assessment: Hilco Industrial provides precise valuation services, ensuring that companies understand the true worth of their assets. This is crucial for making informed purchasing decisions and achieving maximum return on investment.

- Turnkey Solutions: Hilco Industrial offers comprehensive, turnkey solutions that handle every aspect of the process—from asset valuation and marketing to sale and logistics. This ensures a seamless transition for companies relocating their operations or upgrading their equipment.

- Global Reach and Marketing: With an extensive international network, Hilco Industrial can market assets globally, reaching a vast audience of potential buyers. This global reach maximizes exposure and ensures optimal returns for sellers.

- Custom Strategies: Hilco Industrial develops tailored strategies to handle complex transactions, ensuring that all aspects of the asset disposition process are managed effectively. This includes managing work-in-process assets, converting them into finished goods, and marketing them efficiently.

Conclusion

The ongoing shifts in global steel production present substantial opportunities for companies looking to acquire used equipment. Hilco Industrial’s expertise in asset valuation, comprehensive turnkey solutions, global marketing reach, and custom strategies make it an ideal partner in navigating these opportunities, ensuring value maximization and seamless operational transitions for companies worldwide.

References

OECD’s report on steelmaking capacity and other resources from industry experts.